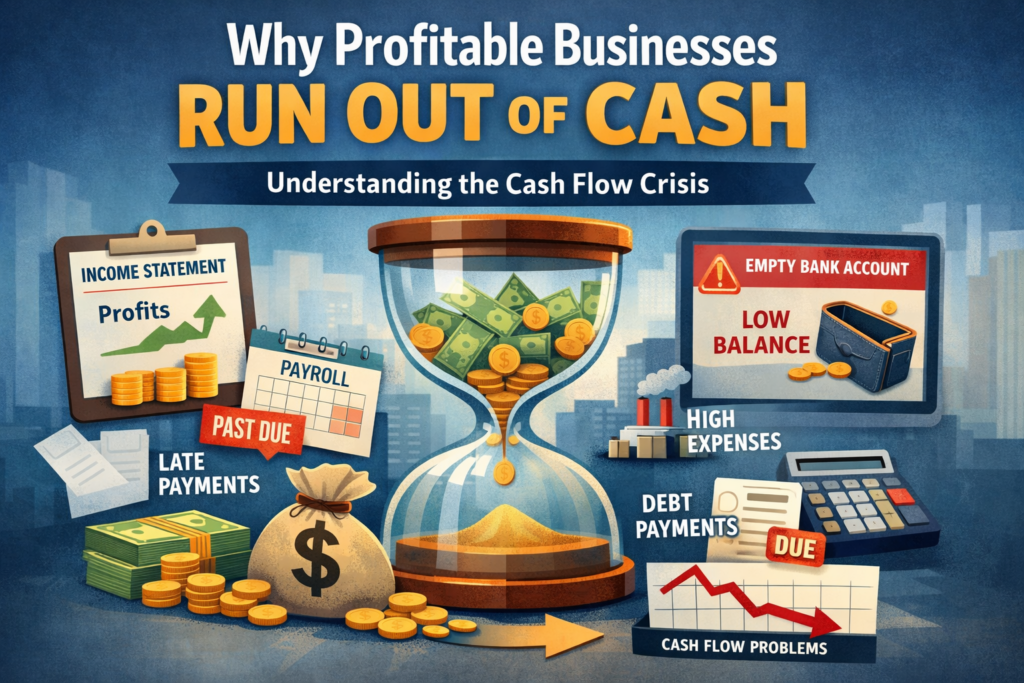

One of the most confusing and frustrating experiences for business owners is being profitable on paper while still feeling constant cash pressure. The income statement may show healthy profits, yet the bank balance tells a very different story. This disconnect is far more common than most owners realize, and it is one of the leading causes of business stress, emergency borrowing, and in severe cases, business failure.

Understanding why this happens and how financial analysis helps prevent it is essential for running a stable, scalable business.

Profit and Cash Are Not the Same Thing

The root of the problem is that profit and cash measure two different things. Profit reflects revenue earned minus expenses incurred during a period, regardless of when money actually moves. Cash reflects the timing of real dollars coming in and going out of the business.

A company can record revenue today but not collect payment for 30, 60, or even 90 days. At the same time, it may be required to pay employees, vendors, rent, and taxes immediately. The income statement looks strong, but cash is being consumed faster than it is replenished.

Financial analysis forces business owners to confront this timing gap. When cash flow is reviewed alongside profitability, it becomes clear whether growth is sustainable or quietly draining liquidity.

Growth Often Consumes Cash

Ironically, growth is one of the biggest reasons profitable businesses run out of cash. As revenue increases, so do the demands on working capital. More sales often require more inventory, more labor, and higher operating costs before cash is collected from customers.

For example, a service business may hire additional staff to support new clients, but client payments may lag behind payroll by several weeks. A product-based business may invest heavily in inventory months before those products are sold. On paper, margins may look healthy, yet cash is tied up in receivables or inventory.

Financial analysis helps owners model the cash impact of growth before it happens. By understanding working capital requirements, owners can pace growth, adjust payment terms, or secure financing proactively rather than reactively.

Accounts Receivable Can Quietly Strain Cash

Late-paying customers are one of the most common cash flow killers in otherwise profitable businesses. Revenue is recognized, taxes may be owed on that income, but cash has not yet been received.

Without proper analysis, owners may underestimate how much cash is trapped in accounts receivable. Over time, slow collections can create a cycle where new sales are needed simply to cover old obligations.

Regular review of receivables aging reports highlights collection issues early. Financial analysis also helps owners evaluate whether customer payment terms align with the business’s cash needs. In many cases, small changes in billing practices or follow-up procedures can dramatically improve cash flow.

Inventory and Prepaid Expenses Reduce Liquidity

Inventory-heavy businesses often experience cash strain even when profits are strong. Cash is spent upfront on inventory that may not convert to sales for weeks or months. Prepaid expenses, such as insurance or annual software subscriptions, further reduce available cash without immediately affecting profit.

Financial analysis reveals how much cash is locked into these assets and whether inventory turnover is healthy. Owners who monitor these trends can reduce excess inventory, renegotiate purchasing schedules, or adjust pricing to improve cash conversion.

Debt Payments and Taxes Create Cash Pressure

Debt service is another area where profit and cash diverge. Loan principal payments reduce cash but do not appear as expenses on the income statement. Similarly, tax payments often relate to prior-period profits, creating cash obligations that feel disconnected from current performance.

Businesses that focus only on profitability may be surprised when large loan or tax payments strain liquidity. Financial analysis incorporates these obligations into cash flow projections, allowing owners to plan ahead rather than scramble when payments come due.

Why Financial Analysis Is the Solution

Financial analysis transforms raw financial statements into actionable insight. It allows business owners to see how cash actually moves through the business and where pressure points exist.

By analyzing cash flow statements, working capital trends, and timing differences between income and expenses, owners can anticipate shortfalls months in advance. This foresight enables better decisions around hiring, capital expenditures, pricing, and financing.

More importantly, financial analysis shifts management from reactive to proactive. Instead of responding to cash crises, owners can prevent them entirely through better planning and disciplined financial oversight.

Turning Profit Into Stability

Profitability is essential, but it is not enough on its own. Cash is what keeps the business operating day to day and provides the flexibility to invest, grow, and weather uncertainty.

Business owners who understand why profitable companies still run out of cash gain a critical advantage. With the right financial analysis in place, profit can be converted into predictable cash flow, reducing stress and creating long-term stability.

When owners manage with both profit and cash in mind, they stop being surprised by their finances and start controlling them.