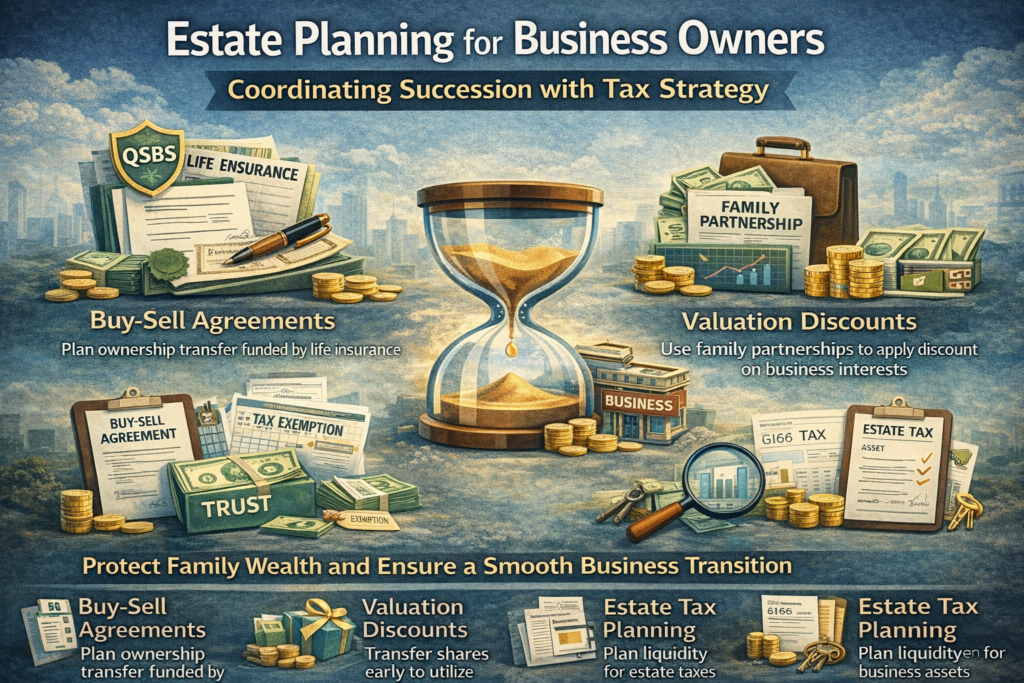

For business owners, estate planning is not just about passing on personal wealth, it is about ensuring the continuity and stability of the business itself, while minimizing tax exposure and protecting family interests. Effective estate planning for business owners requires a coordinated approach that integrates business succession planning with sophisticated tax strategies. This involves careful alignment of buy-sell agreements, the use of valuation discounts, gifting strategies, and estate tax planning tools to preserve both the business and family wealth.

Buy-Sell Agreements: Foundation of Succession Planning

A well-drafted buy-sell agreement is a cornerstone of business succession planning. It provides a clear mechanism for the transfer of ownership upon the death, disability, or retirement of an owner. These agreements can be structured as cross-purchase agreements (where co-owners buy out the departing owner’s interest) or redemption agreements (where the business itself redeems the shares). Funding these agreements with life insurance is common, ensuring liquidity to complete the purchase without disrupting business operations.

However, recent legal developments, such as the Supreme Court’s decision in Connelly v. United States (2024), have clarified that life insurance proceeds received by a corporation to fund a redemption must be included in the value of the business for estate tax purposes, and the redemption obligation does not offset this value. This means that the estate tax value of the business may be higher than anticipated, potentially increasing the estate tax liability. Therefore, buy-sell agreements must be carefully structured and regularly reviewed to ensure they reflect fair market value and comply with current tax law, including the requirements of IRC section 2703, which disregards certain restrictions or agreements unless they are bona fide business arrangements, not devices to transfer property to family for less than full value, and are comparable to arm’s-length transactions [3].

Valuation Discounts: Leveraging Lack of Control and Marketability

Business owners often use family limited partnerships (FLPs), LLCs, or similar entities to transfer interests to family members. These interests may qualify for valuation discounts due to lack of marketability and lack of control, reducing the taxable value of the transferred interests. For example, a minority interest in an FLP that holds marketable securities may be valued at a significant discount from the pro rata value of the underlying assets, reflecting the reality that such interests are harder to sell and do not confer control.

However, the IRS has targeted aggressive discounting, especially in family-controlled entities, and proposed regulations under section 2704 would further restrict the use of discounts where liquidation restrictions are disregarded for valuation purposes. To withstand IRS scrutiny, it is essential that these entities are operated in a businesslike manner and that any restrictions or discounts are commercially reasonable and not simply devices to reduce estate or gift tax.

Gifting Strategies: Taking Advantage of Exemptions and Future Growth

Gifting business interests during life can be a powerful strategy, especially in light of the historically high federal gift and estate tax exemption. By transferring interests now, owners can remove future appreciation from their taxable estates and potentially leverage valuation discounts to maximize the amount transferred tax-free [6].

Gifts can be made outright or in trust, such as to grantor retained annuity trusts (GRATs) or irrevocable life insurance trusts (ILITs), to provide additional control and creditor protection. When using trusts, it is important to ensure that the trust structure is compatible with the business entity’s requirements (e.g., S corporation shareholder eligibility rules).

Estate Tax Planning: Liquidity and Deferral Options

Even with careful planning, estates with significant business interests may face liquidity challenges in paying estate taxes. IRC section 6166 allows qualifying estates to defer payment of estate tax attributable to closely held business interests over up to 14 years, provided the business interest exceeds 35% of the adjusted gross estate. This can help avoid forced sales or disruption of business operations. Other options include estate loans or requests for payment extensions under section 6161, though these are subject to strict requirements and may accrue interest.

Conclusion

Coordinating business succession with tax strategy is essential for business owners who wish to protect both their business and family wealth. This requires a holistic approach—aligning buy-sell agreements with current law, leveraging valuation discounts appropriately, utilizing gifting strategies before exemption limits drop, and planning for estate tax liquidity. Regular review and adjustment of these strategies, in consultation with experienced advisors, will help ensure a smooth transition and the preservation of value for future generations.