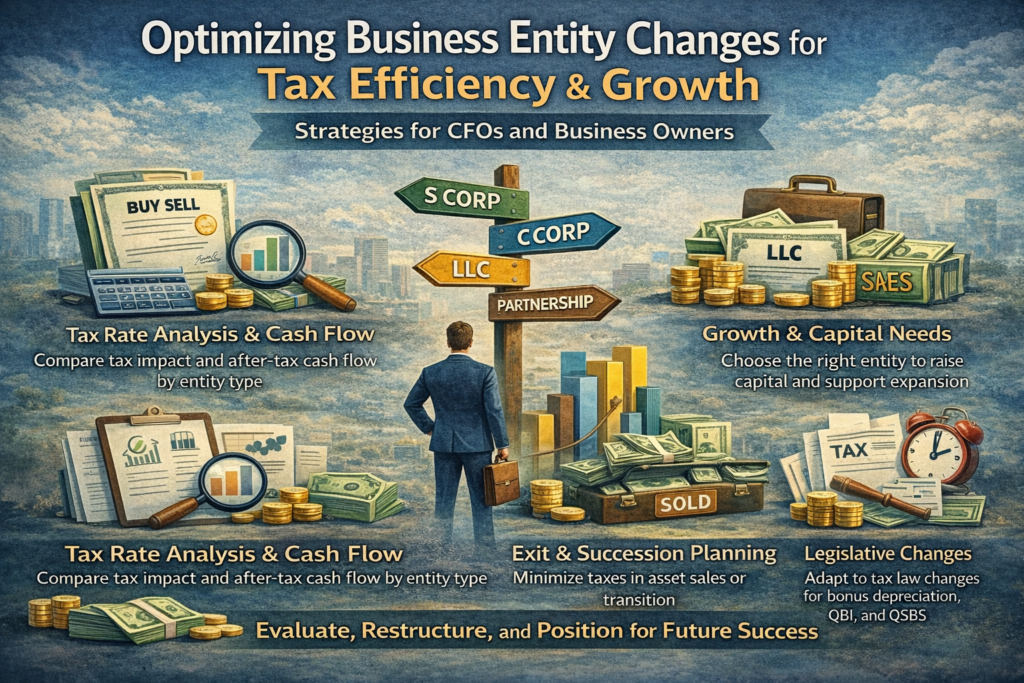

In today’s dynamic business environment, the choice of legal entity whether S corporation, C corporation, partnership, or LLC can have a profound impact on a company’s tax efficiency, access to capital, and long-term growth prospects. For CFOs, periodically reevaluating and, when appropriate, restructuring the entity form is a strategic lever to unlock tax savings and better position the business for future opportunities.

Why Consider an Entity Change?

The U.S. tax landscape has shifted significantly in recent years, with the corporate tax rate now at 21% and the qualified business income (QBI) deduction for pass-through entities (like S corporations and LLCs taxed as partnerships) offering a 20% deduction for eligible income. These changes, along with evolving business needs such as raising capital, planning for an exit, or expanding internationally mean that the “right” entity structure for a business can change over time.

Key Considerations for business owners

- Tax Rate Analysis and Cash Flow

- C Corporations pay tax at the entity level (21%), and distributed earnings are taxed again at the shareholder level, resulting in an effective tax rate on distributed profits of about 40%. However, if profits are reinvested rather than distributed, the single-layer 21% rate can be advantageous for growth-oriented companies.

- S Corporations and LLCs (as pass-throughs) avoid entity-level tax; income is taxed once at the owner’s rate (up to 37%, or 29.6% with the QBI deduction). This structure is often more tax-efficient for businesses that distribute most of their earnings or have owners in lower tax brackets.

- Growth and Capital Needs

- C Corporations are generally preferred for companies seeking to raise capital from institutional investors or go public, as they allow for multiple classes of stock and unlimited shareholders. They also facilitate stock-based compensation and access to certain tax benefits, such as the expanded qualified small business stock (QSBS) exclusion, which can allow shareholders to exclude up to $15 million (or 10x basis) in gains on the sale of qualified stock held for at least five years.

- S Corporations and LLCs are often better for closely held businesses prioritizing current income distributions and flexibility in allocating profits and losses.

- Exit and Succession Planning

- The tax cost of selling a business can differ dramatically by entity type. C corporation shareholders may face double taxation on asset sales, while S corporation and partnership owners typically pay a single layer of tax on gains. However, C corporations may offer planning opportunities, such as QSBS or step-up in basis at death, to mitigate this.

- Recent Legislative Changes

- The 2025 tax year brings restored 100% bonus depreciation and permanent QBI deduction, both of which can influence the optimal entity choice. The expanded QSBS rules and increased interest deductibility under section 163(j) also favor C corporations in certain scenarios.

Planning and Executing an Entity Change

Changing entity type is not a decision to take lightly. Converting from an S corporation or partnership to a C corporation is generally tax-free, but going the other way (C to S or partnership) can trigger immediate tax on built-in gains, recapture of depreciation, or other deferred items. Business owners should model the immediate tax cost of conversion against the projected long-term tax savings and strategic benefits.

Best Practices for Business owners:

- Model multiple scenarios: Use tax technology and forecasting tools to compare after-tax cash flows, effective tax rates, and exit outcomes under different structures.

- Consider timing: Align entity changes with business cycles, anticipated capital raises, or before major asset sales to optimize tax outcomes.

- Coordinate with advisors: Work with tax, legal, and financial advisors to ensure compliance, manage risks, and document the business purpose for the change.

- Monitor legislative developments: Stay alert to proposed changes in tax rates, QBI deduction limits, and capital gains rules that could affect the analysis.

Conclusion

Optimizing your business entity structure is a powerful way to enhance tax efficiency and support growth. By proactively evaluating the fit between your entity type, tax profile, and strategic goals, CFOs can unlock value, improve after-tax returns, and position the business for long-term success.