This is what sets successful small businesses apart from the majority that fail because learning how to create a budget for your business is the foundation of financial stability.

Whether this is your first time creating a budget for your business or you want to revamp your current budgeting method. Learn step-by-step strategies, practical tips, and expert insights to making a budget that streamlines your finances and grow your business.

What’s a business budget?

A business budget is a detailed plan that shows where a business will spend its money every month or year.

You decide where each dollar goes, based on what you think is the best way to use it for your business. Then, you keep track of what you planned and what actually happened. That’s what a budget does.

Why is this important?

In a tough economic situation like the one we’re in, with inflation going through the rough and the possibility of a recession which seems imminent, it’s more important than ever that your business have a budget that can help you predict how much money you’ll make, where you’ll spend it, and how well your plans lines up with reality.

The key to creating a good business budget is that it’s simple and adaptable. If things change (which they often do in business), your budget should change with them, so you always know where your business stands financially.

Every good budget should include at least these 7 categories:

- Estimated Revenue: This is the total amount of money you expect your business to earn from selling your products or services, regardless of the expenses you spent to make it.

This is the first item on your budget. You can estimate it based on your past year’s earnings if you’ve been in business for a while. But if you’re a new business, you might use industry standards or averages as a reference point to make this estimate.

-

- Fixed Costs: These are the regular, ongoing expenses in your business.

These expenses are the stable, predictable costs that you can count on every month or year, to stay the same. For example, things like rent for your office space, insurance, utility bills, fees you pay to the bank, professional services like accounting and legal help, and costs associated with leasing equipment.

-

- Variable Costs: These are expenses that change based on your business’s production or sales volume, and are directly linked to the products your business sells and can encompass various items.

This might include: costs of raw materials, inventory, production expenses, packaging, and shipping. Additional variable costs could involve items like sales commissions, credit card fees, and travel expenses. To effectively manage your finances, create a well-structured budget that clearly outlines your projected spending for each of these variable costs.

Salaries can be a bit tricky as they can fall into both fixed and variable cost categories.

Your administration team’s salaries are usually considered fixed costs because they remain relatively stable regardless of your production or sales volume. Salaries related to production/manufacturing teams, who are directly involved in making your goods, and sales teams that work on commission would be variable costs because they fluctuate with the production and sales levels.

It’s important to allocate these salary costs in your budget to reflect whether they’re fixed or variable.

-

- One-Off Costs: Often referred to as “one-time costs,” are expenses that don’t occur as part of your regular business operations.

These are typically associated with special or unique circumstances. In many cases, they are incurred when your business is just starting out or when you’re making significant changes. For example, moving to a new office, purchasing equipment, buying furniture, acquiring software, launching new products, or conducting research.

These costs are distinct from your usual ongoing expenses and should be budgeted separately.

-

- Cash Flow: The lifeblood of your business.

It’s all the money that flows in and out of your business. More money coming in than going out, is positive cash flow (and vice versa). You can calculate it by looking at the money you have at the start and end of that period.

It’s crucial to keep an eye on your cash flow regularly, like every week or at least every month.

Even if you’re making a lot of money, you might not have enough cash on hand to pay your bills or suppliers. It’s like tracking your financial health to make sure your business stays afloat.

-

- Profit: Profit is how much you actually made after subtracting expenses from the revenue.

You plan your profit based on your expected income, costs, and expenses. Growing profits mean a growing business. If your profit margins aren’t looking as good as you want them to, consider adjusting your prices, figure out if you can reduce your expenses, or think about investing more in advertising to increase your sales.

-

- A Budget Calculator: Shows you all the important numbers in your budget in one clear summary.

To create one, start with a basic budget framework that includes all 7 categories. Then, track your actual spending in each category. This “snapshot” makes it easy to see where your business budget stands without digging through complex spreadsheets. It’s like a clear financial overview for your business

Let’s break down the budgeting factors for different types of businesses:

Seasonal Businesses:

-

- For businesses with busy and slow seasons, budgeting is even more crucial to manage the irregular cash flow.

-

- Budgets help you analyze your past data, predict your future cash flow, and identify trends.

-

- During slow seasons, businesses can plan, negotiate with vendors, and build customer loyalty.

- Forecasting is an evolving process, so start with what you know, and make your best educated guesses for unexpected costs. It’s better to set aside money for an emergency than be blindsided by unwanted surprises.

Ecommerce Businesses:

-

- Shipping is a major budget factor for ecommerce businesses.

-

- Assess if your budget can cover shipping costs to customers, and consider alternatives like flat rate shipping or real-time quotes.

-

- Include packaging costs in the cost of your “goods sold.”

-

- Account for any international warehousing expenses and duties.

- Invest in a good web hosting service, web design, product photography, advertising, blogging, and social media to enhance your customers online shopping experience.

Inventory Businesses:

-

- Factor in the cost of goods sold to account for stocking up on inventory to meet demand.

-

- Use previous year’s sales or industry benchmarks to estimate the amount of inventory you’ll need.

-

- Research upfront to get the best prices from vendors and ship the right amount to satisfy needs and manage costs.

-

- Consider how the volume of your inventory affects pricing and your overall spending.

- You may also need to include the costs of storage solutions or disposal of leftover stock.

Custom Order Businesses:

-

- Factor in labor time, cost of operations, and materials for custom-ordered goods.

- Make an average estimate since these costs can vary per order.

Startups (A bit tricky because there’s no exact model to use):

-

- Research your industry’s benchmarks for salaries, rent, and marketing costs.

-

- Seek advice from your network on professional fees, benefits, and equipment expenses.

-

- Allocate a portion of your budget for advisors (accountants, lawyers, etc.) to avoid legal fees and inefficiencies later on.

- This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. Send us a message to help you set up a tailored budget for your business’s unique needs.

Service Businesses:

-

- Focus on projected sales, revenue, salaries, and consultant costs.

- Be flexible in your budget as the figures can vary widely based on the number of people needed, their cost, and fluctuating customer demand in industries like accounting, legal services, creative, or insurance.

Each type of business has unique budgeting needs, and it’s essential to tailor your budget to your industry and business type for effective financial management and to ensure stability and growth.

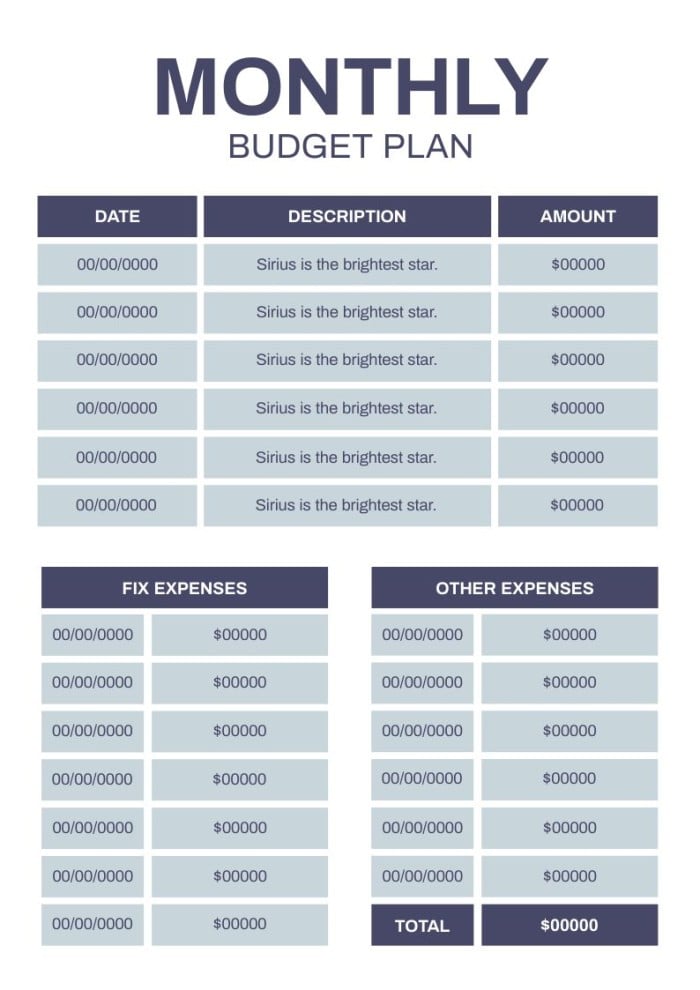

Small business budgeting templates come in various forms

These templates can be as simple as a basic table, like above, or a more complex with multiple page spreadsheet with detailed calculations. The key is to choose one that suits your needs and preferences. Keep these points in mind as you pick one for your business:

-

- Simplicity Is Key: Ensure that the template is straightforward and easy to work with. A complex template may become a burden rather than a useful tool.

-

- Yearly Budget: Start with a 12-month budget as it’s usually the standard approach. This’ll provide a comprehensive overview of your financial planning for the year.

-

- Regular Updates: It’s essential to update your budget regularly, consider incorporating quarterly or monthly updates into your budgeting process. Regular check-ins help you stay on top of your financial goals and make necessary adjustments as the year progresses.

The goal is to create a budgeting template that simplifies the financial management of your small business and keeps you informed about your financial performance throughout the year.